Fine

line

n

n

n

With an eye towards the united states

With average prices in the New York Stock Exchange as high as US$ 0.87 per pound, in the first half of May 2017, it was a good

moment for the farmers to keep prices high. “However, it was an exaggerated and non-consistent price. Market foundations

show that it is possible to raise prices above the 2016 levels, but there will hardly be any chance for prices to exceed US$ 0.90 per

pound. The trend is for consolidating the price of US$ 0.80 per pound”, argues consultant Élcio Bento. He has it that prices in the

United States in August, when harvest begins, will dictate the behavior of the international quotes and, by extension, in Brazil.

Bento observes that, despite the receding global stocks for the third year in a row, they still amount to 18million tons of fiber,

half of it in China. Although there may be doubts about the quality of the fiber stored in the eastern giant, the fact is that there

are still 8 to 9 million tons of fiber above the amounts in the 2009/10 crop year, when international prices skyrocketed. The pro-

jections by the New York Stock Exchange anticipate prices of US$ 0.78 per pound in June 2017 and US$ 0.75 per pound in Octo-

ber 2017. “July contracts are important because they bring the commercial year to a close”, he concludes.

For his part, Arlindo Moura, president of the Brazilian Association of Cotton Producers (Abrapa), points to the fact that by the

end of May 2017 more than 65% of the Brazilian crop had been traded in anticipation. About 30 percent of the 2017/18 cotton

crop, to be planted at the end of the year, has already been negotiated in advance.

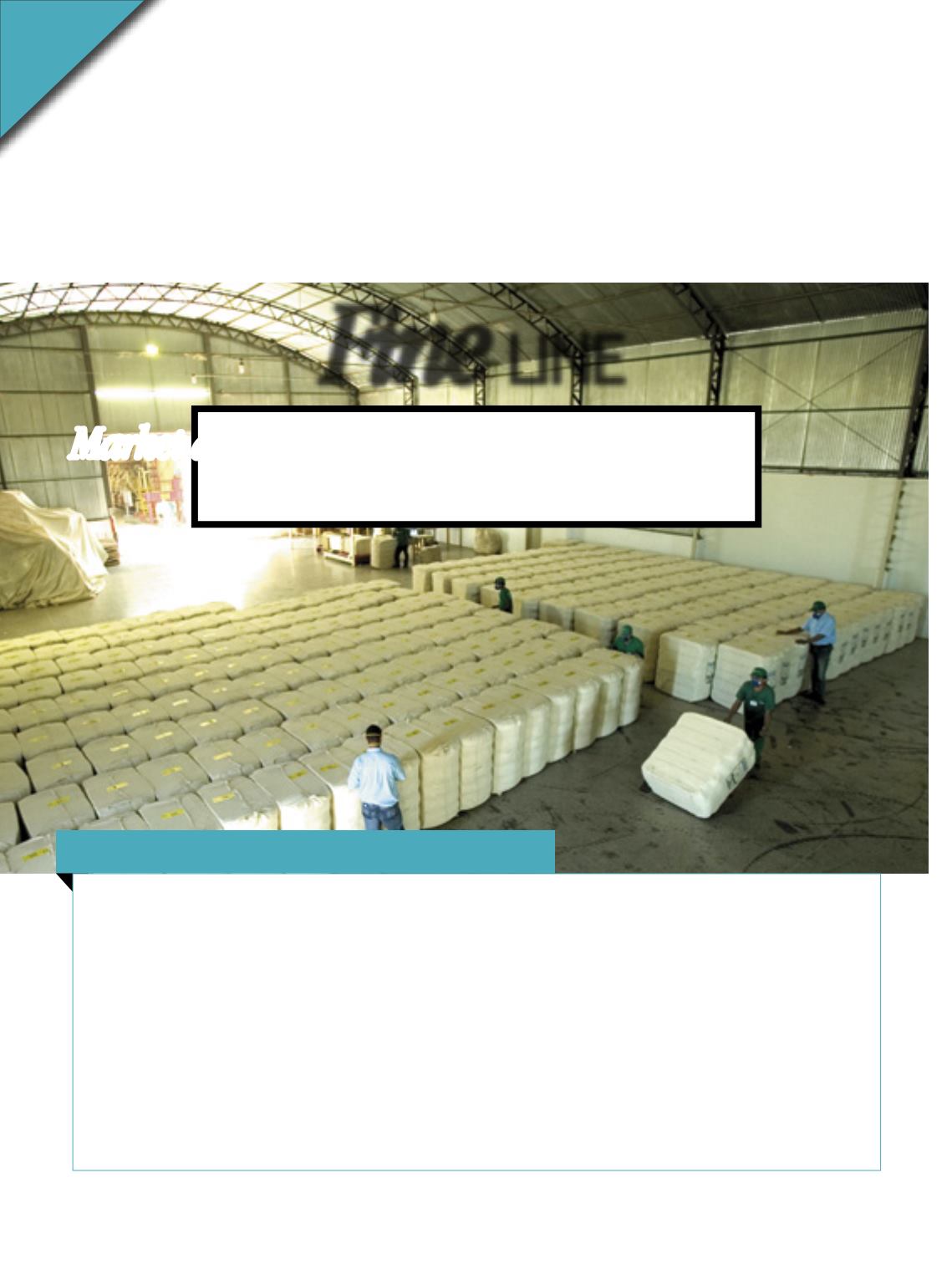

T

he smaller Brazilian crop, si-

multaneously with the reced-

ing global stocks, made it nec-

essary for the national cotton

market to adjust to a new reality

inthefirsthalfofthe2017calendaryear(Jan-

uarythroughDecember).Abroad,quotations

demonstrate gradual forward movement,

with minor surprises stemming fromChina’s

stock exhausting efforts. InBrazil, prices took

off andmade rather firmstrides, as a result of

scarceavailabilityoffiberinthe2016/17com-

mercial year (August toJuly).

With a 17.5-percent smaller crop in the

2015/16 season, which yielded 1.29 mil-

lion tons of fiber, against a forecast of near-

ly 1.49 million in the 2016/17 crop year, in-

duced the local companies to direct part

of their businesses to the internal mar-

ket, which paid higher prices. As the fal-

low period in Brazil and the world went by,

and with indications of a drop in the glob-

al stocks, along with exchange rate impli-

cations, prices in Brazil soared throughout

the first months of the year.

In April 2017, for example, the highest av-

erage price in Brazilian currency up to that

Market adapts to the new reality

ofofferanddemand,andpriceskeeppacewiththewindsof

themarket,butwithexpectationsofprofitsforthesector

Sílvio Ávila

Receding supply pushes up domestic prices, but harvest will trigger competitiveness

42