Exportsofsoybeankernelsarestill

inhibitingvalue-addingefforts

Soybeanprocessingindustrycrushed40.566million

tons in2015,but itscapacity is fornearly60milliontons

Extra

breath

Brazilboaststhecapacitytoprocessnear-

ly60million tons of soybeana year. Thiswas

the capacity in 2014, according to sourc-

es from the Brazilian Vegetable Oil Indus-

tries Association (Abiove). The processing of

40.556milliontonswastheamountreached

in 2015 and outstripped all results achieved

in the previous years. With regard to the vol-

ume industrialized in 2014, it represented

an increase of 7.8%, or 2.934 million tons,

fromfigures released by the Abiove.

The entity mentions that the volume in-

dustrialized in the Country represents only

41%of the Brazilian soybean crop. This share

attests to the existing potential for expanding

the production of soybeanmeal. The produc-

tionof96.9milliontonsofsoybeanandtheex-

portation of 54.3 million tons also hit record

numbers in 2015. The historical results had a

repeat in production, consumption and ex-

ports of meal and in the domestic scenario of

oil supply and demand. The availability of the

products could go up even further with the

processing of the soybean kernels that are ex-

ported,saysourcesfromtheAbiove.

The production of soybean meal amount-

ed to 30.765 million tons in 2015, with 16.017

million tons destined for domestic consump-

tionand14.796milliontonsfortheforeignmar-

ket. Thesevolumeswereup2.013million tons,

1.218 million tons and 979 thousand tons, re-

spectively, from the previous year. Bigger de-

mand for the production of animal feed and

declining supply in Argentina, leading global

producer,hadasayinthehigherresultsin2015.

The domestic market demanded 6.521

million tons of soybean oil in 2015, and total

productionremainedat8.074milliontons,ac-

cording to Abiove sources. Exports amount-

ed to 1.665 million tons. The production vol-

umes, domestic and foreign consumption of

the oil were up 631 thousand tons, 412 thou-

sand tons and 370 thousand tons, respective-

ly, from the year before. The bigger share of

biodiesel in fossil diesel favored the domestic

demandforthevegetableoil.

Theexportsofthesoybeancomplexwere

positive in 2015, with higher volumes, but

revenue in dollar was smaller. Shipments to-

taled 54.324 million tons of soybean kernels,

14.827 million tons of meal and 1.67 million

tons of oil, up 19%, 8%and 28%, respective-

ly, from the shipments in 2014. The figures

comefromtheAbiove,basedonthenumbers

released by the Secretariat of Foreign Trade

(Secex)oftheMinistryofDevelopment, Indus-

try and Foreign Trade (MDIC).

Hefty contribution

Invalues, shipmentsbrought inUS$27.96billion in2015, not asmuchas theUS$31.4bil-

lion in the previous year. The blame goes to the lower average price per ton of the soybean

complex, as it was responsible for the smaller export FOB value. The decrease reached 24%

inkernelexports,23%inmealexportsand20%insoybeanoilexports.Ofthetotal,US$20.98

billion (75.1%) referred to soybean kernel exports, US$ 5.82 billion (20.8%) tomeal and US$

1.2 billion (4.1%) to soybean oil sales. The sumof the three products represented a share of

14.6%of all national exports registered in 2015.

Nonetheless, according to Abiove sources, the Country is losing its representation in ex-

ports of soybeanmeal and oil, as a result of the absence of value-adding policies. Exports of

soybean kernels increased its share in revenue from13% in 1981 to 75% in 2015, while ship-

ments ofmeal andoil dropped from87%to25%, during the sameperiod. Opposite result in

Argentina, a country that ranked as biggest soybean oil andmeal exporter.

AccordingtoAbioveofficials,theindustryofthesoybeancomplexislosinggroundtoChinese

competitors. The government in China lends support to value adding initiatives and to the gen-

eration of jobs through suchmeasures as the 4-percent import tariff intended to protect the lo-

calindustry,publicinvestmentintheindustryandsupplyofrawmaterial.Chinaequallyprotects

itsownvalue-addedmarketwithtechnicalandphytosanitarybarriers.Inthecountry,shipments

abroad of soybean kernels are exempt fromsocial security contributions, while the byproducts

aretaxedbypercentagesoftheseproductsgeneratedduringtheproductionprocessforexports.

Brazil is the fourth largest soybean processor in the world, coming only after China, the

United States and Argentina. In August 2015, the US Department of Agriculture (USDA), had

estimated that China would process 81.8 million tons in the 2015/16 growing season. Global

crushing for theperiodwas estimatedat 278.65million tons.

62

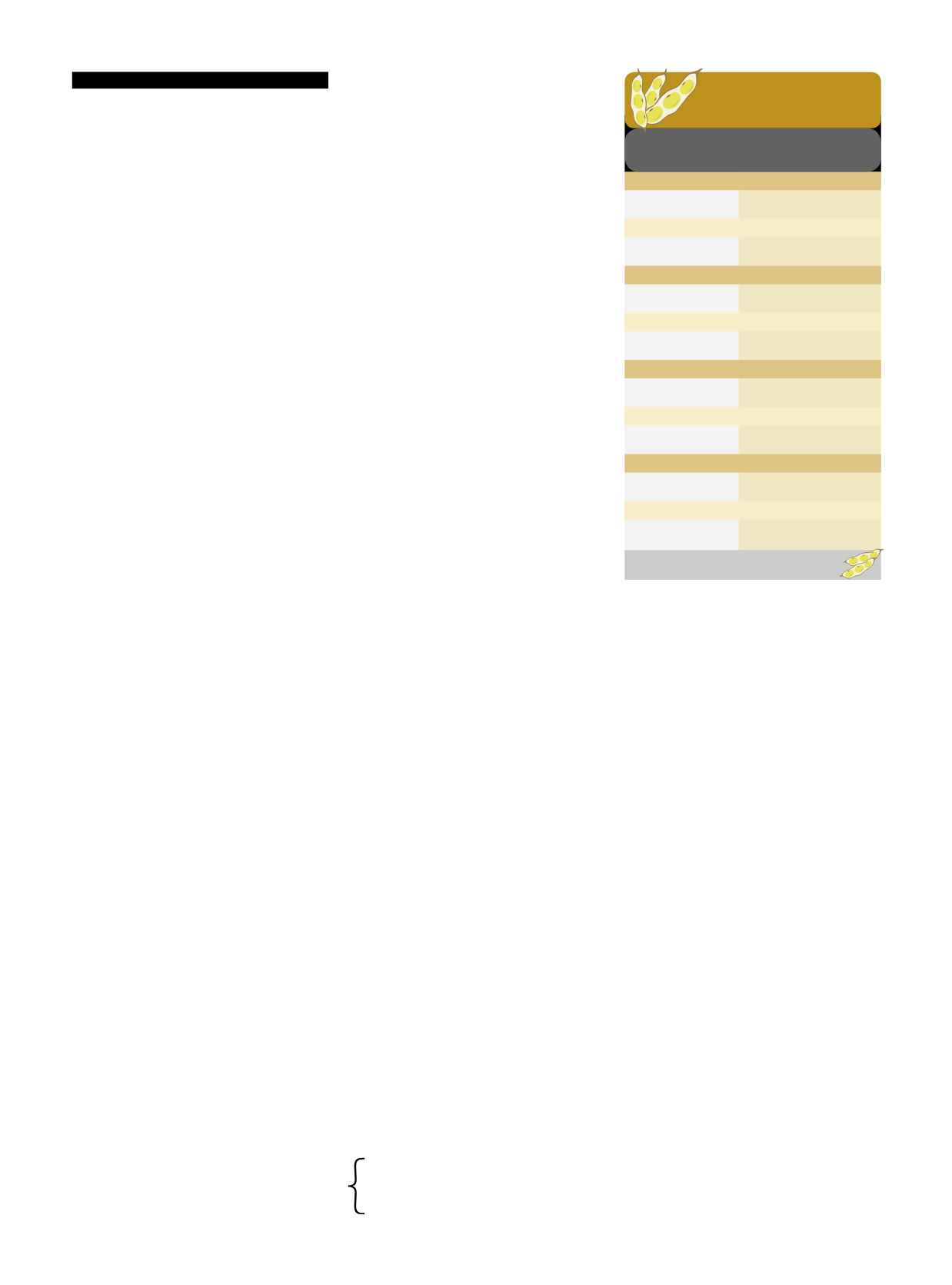

* Estimativa – ** Previsão.

Fonte:

Abiove – 29/09/2016.

PARCELAS

Shares

Os números da industrialização

da soja no Brasil

2014

Produção

86,397 milhões de t.

Processamento 37,622 milhões de t.

Exportação

45,692 milhões de t.

2015

Produção

96,994 milhões de t.

Processamento 40,556 milhões de t.

Exportação

54,324 milhões de t.

2016*

Produção

94,600 milhões de t.

Processamento 40,300 milhões de t.

Exportação

52,500 milhões de t.

2017**

Produção

101,300 milhões de t.

Processamento 41,000 milhões de t.

Exportação

57,000 milhões de t.