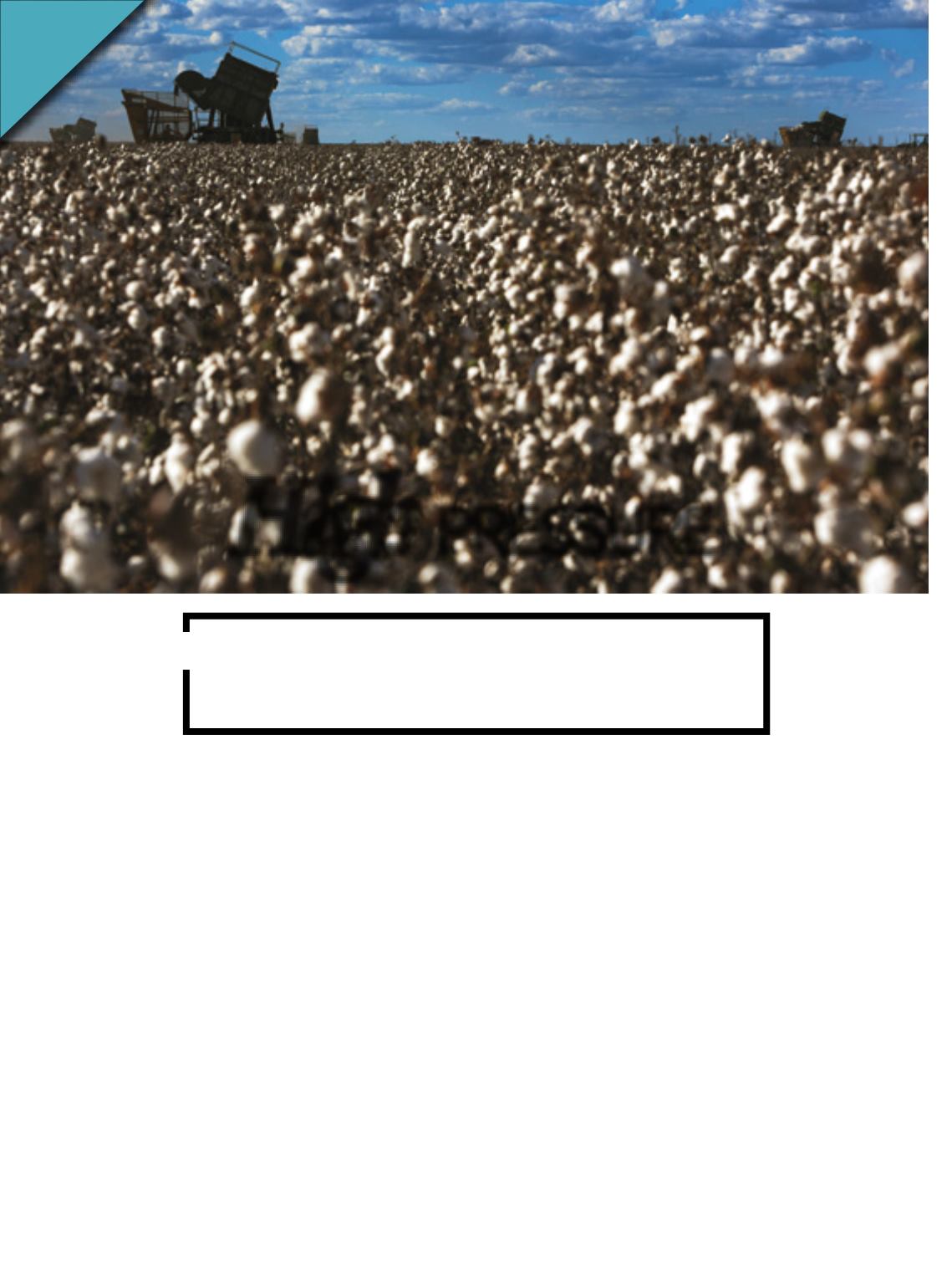

Severe droughts hit northeastern

cottonfieldsduringthreeyearsinarow,causingsignificant

damagesandlossesinthe2015/16growingseason

High

pressure

U

nder bad weather conditions,

which for the third year in a

row adversely affected the

cotton fields in the Northeast,

the cotton supply chain har-

vested a crop that was 17.5% smaller in

the 2015/16 crop year. The low sales pric-

es, stemming from the severe economic

crisis, aggravated by the political turmoil;

the exchange rate oscillations and an inter-

national structure characterized by low de-

mandaffectedtheprofitsandrequiredhigh-

er economic and commercial management

capacity fromfarmers and industries.

According to the final figures released by

theNationalFoodSupplyAgency(Conab),in

2016 the size of the cotton crop in the Coun-

try was 1.29 million tons smaller in terms

of fiber, resulting from both the 2.2-percent

smaller planted area (954.7 thousand hect-

ares) and 15.6% lower productivity (1,350

kilograms of lint per hectare). Climate con-

ditions could not have beenworse, as it was

dry at planting time and excessively wet at

harvest in the states of Bahia (second larg-

est producer in Brazil), Maranhão and Piauí.

In spite of the adverse weather conditions,

quality was not affected.

Availability of fiber for export was lim-

ited and, equally because of this, foreign

sales dropped 6%, to 804 thousand tons. In

the domestic scenario, although demand

was scarce, and by virtue of the oscillation

of theNorthAmerican currency, priceswent

up 22% from December 2015 to December

2016, with an arroba rising fromR$ 74.10 to

R$ 90.48. The president of the Brazilian As-

sociation of Cotton Producers (Abrapa), Ar-

lindo de Azevedo Moura, regretted the fate

of the sector. “We must stay focused on

the fact that the cotton farming production

cost is very high – about R$ 8 thousand per

hectare – due to the high demand of invest-

ments involved. Entering into this business

or gettingout of it is very difficult”, he argues

In his view, the number of cotton farm-

ers in Brazil has been on the decline over

the past five years. The blame goes to the

ever-decreasing profits, at a time when oth-

er crops like soybean, whose production

cost remains at R$ 2.5 thousand per hect-

are, offer more liquidity. According to him,

for the supply chain to make progress over

the coming seasons, there is need for glob-

al and domestic consumption to gradually

recover. “In the international scenario, this

will dependonmacroeconomic factors and,

particularly, on the behavior of the Asian

markets”, he comments. “In the domestic

marketweareengaged inavery strongmar-

keting campaign, seeking an 11percent in-

crease in the consumption of fiber over the

next 10 years. The expectation for a gradu-

al recovery of the economy, although taking

longer than previously estimated, is also an

encouraging factor.

Sílvio Ávila

22