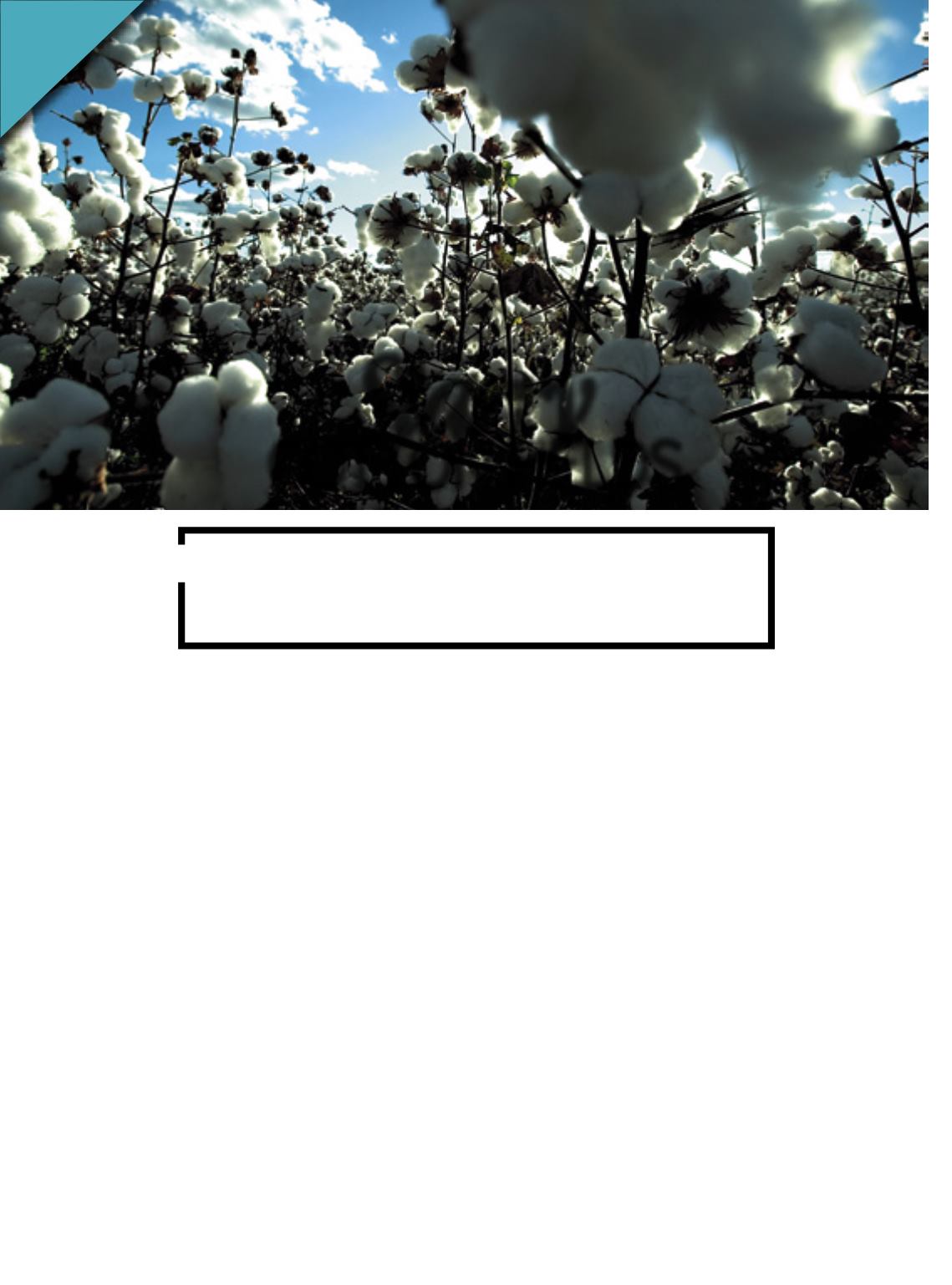

Starry

cottonfields

B

razil’s cotton farming business

got off to a good start in 2017,

projecting productive and prof-

itability recovery of the fields

and cotton based products. The

2016/17 cotton crop and the scenario of the

market are confirming this trend, anticipat-

ingatimeofgreatavailabilityoffiberinBrazil,

in light of crop failures in other countries and

declining global stocks, besides remunerat-

ingprices, despite thehighproductioncosts.

With about 70%of the cropmarketed in

May,pricesoverthefirsthalfoftheyear–off-

season quotes – had been promising and

within projections, with the farmers earning

a 6% to 8% higher income, and the trend is

for the prices to continue rising throughout

the year, depending on the region. Domes-

tic and international prices suffered slight

changes, and the blame goes to the lower

Brazilian crop in the season.

According to ArlindoMoura, president of

the Brazilian Association of Cotton Produc-

ers (Abrapa), the contamination of the eco-

nomic scenario stemming from the political

turmoil couldhave anunpredictable impact

upon theprices of the fiber. Hehad it that an

evenbigger devaluationof the Brazilian cur-

rency against thedollarwould translate into

gains for the farmers, inour national curren-

cy. “Although having a firm market whose

pillars lie on quality and price, a highly val-

ued dollar against the real could generate

more competitiveness”, he recognized.

Upuntilmid-May, the sector was expect-

ing stable sales, with prices remaining un-

changedinthelevelsindicatedbythemarket

andbytheNewYorkStockExchange,butwas

thenunexpectedlyhit by thepolitical turmoil

thatdirectlyaffectedPresidentMichelTemer.

It triggered exchange rate oscillations and af-

fected commercial questions, but the supply

chain understands that the fiber market has

enoughmechanisms tomake sure commer-

cialization remains stable.

“In general, in spite of the ebullient in-

ternal political questions, we expect a year

of normal sales with prices that will make

up for cotton farmers’ investments”, Mou-

ra comments. “Market bases are quite fa-

vorable, particularly by virtue of the falling

stocks, with demand on the rise and our

production volumes are returning to the

levels prior to the years of climate induced

damages”, he stresses.

For the 2017/18 season, the projection

is for a slightly bigger planted area in Bra-

zil, with the expectation of normal weather

conditions. With the confirmation of good

sales prices in the 2016/17 crop year, the

Northeast shouldbe responsible for the big-

gest increase in area. The international sce-

nario points to an additional slight reduc-

tion in the stocks and a bigger share of the

Brazilian cotton in the globalmarket. On the

other hand, Abrapa and the affiliated com-

panies are engaged in campaigns that in-

tend to stimulatenational consumption, en-

couraging the local industry, stimulating the

local industry to use cotton instead of syn-

thetic fibers. “Perspectives are promising

andwe are confident”, Moura summarizes.

remunerativepricesencouragetheBraziliancottonsupply

chaininthe2016/17growingseasoninpursuitofprofitability

Expectations for a huge crop and

Sílvio Ávila

Conjunctural scenarios at home andabroad suggest the development of the sector

12