Inor Ag. Assmann

Countryassumes itspositionasrelevantsupplierof

soybeantotheworld,andtheoilseedistheleading

nationalagriculturalproduceshippedabroad

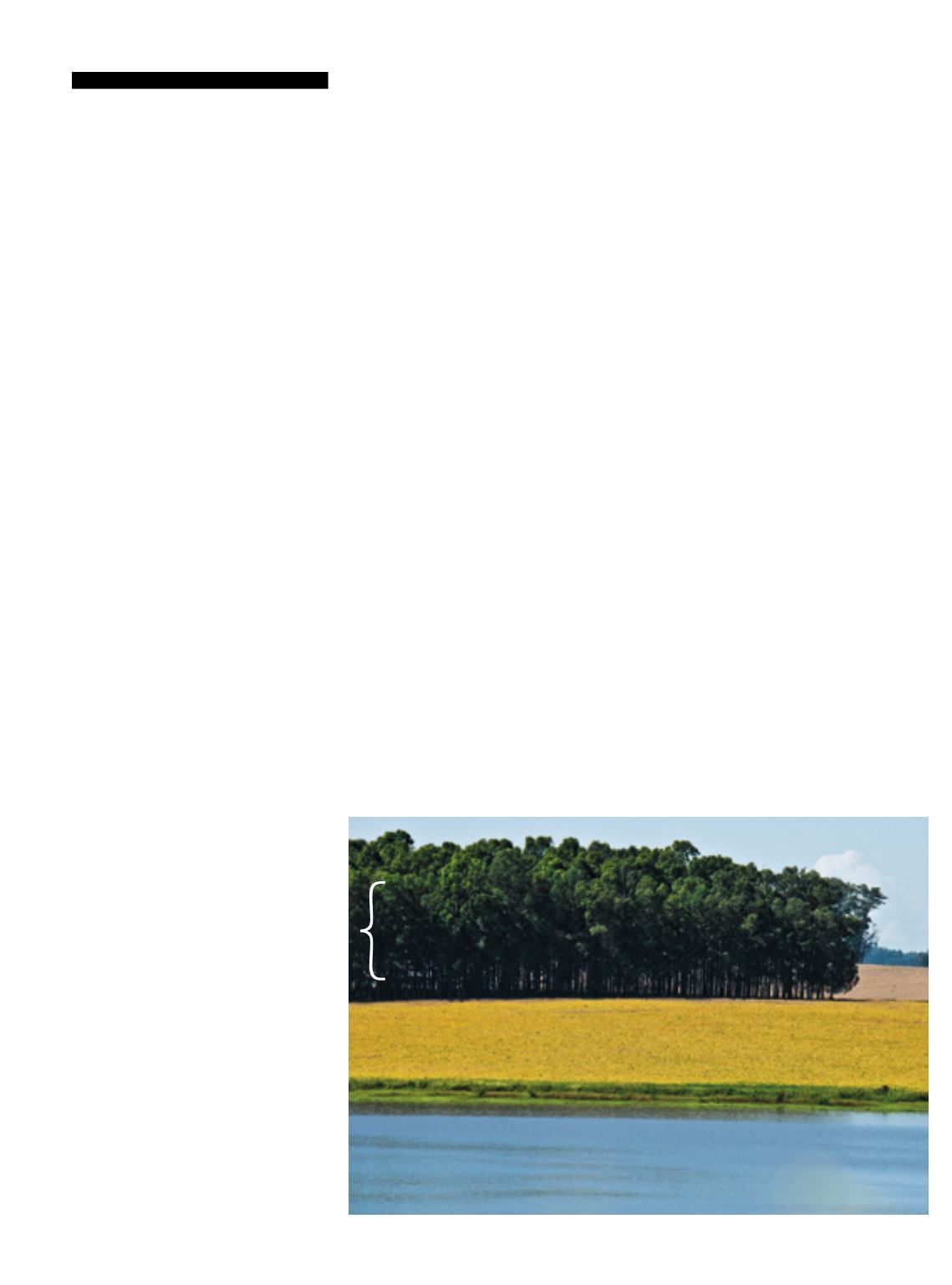

Green plants and yellow kernels identi-

fy Brazil and its leading crop, soybean. It is

the unbeatable leader of Brazilian agribusi-

ness, responsible for 23% of the income

fromtheagricultural segment, and themost

representative item on the national agenda

of exports, not only of the segment, but also

in general, with 10.9% of the total, if only

the kernels are taken into consideration, or

14.6% when meal and oil are included (the

so called soy complex). The trend, accord-

ing to area specialists, is for this situation to

continue for years to come, with the nation

ranking asmajor exporter, besides pursuing

the position as biggest producer.

The Ministry of Agriculture, Livestock

and Food Supply (Mapa), in mid-Septem-

ber 2016, released the information that the

Basic Production Value (BPV) of soybean for

2016 would amount to R$ 118.6 billion, rep-

resenting 23% of the total income derived

from the sector. The estimated amount

would represent a 3.8-percent rise over the

previous year. On the other hand, officials

from the Brazilian Confederation of Agri-

culture and Livestock (CNA), at that time,

were projecting R$ 126.9 billion for the year,

which would indicate 23.5% of the total,

down 2.1% from 2015, by virtue of plum-

metingprices andclimate relatedproblems.

For the upcoming decade, Mapa sourc-

es point to the continuity of the growth

rate, although at a slower pace compared

to the previous period. In their evaluation,

it will be the crop that will expand themost

in area over the decade (10 million hect-

ares in addition to the present 33 million

hectares), totaling 30.2%, or an average an-

nual rate of 2.7%, while over the past 10

years this rate reached 5.8%. On the other

hand, they mention the more conservative

Soyaccountsfor23%ofthe

incomefromagricultureand14,6%

oftheCountry’stotalexports

Arrow

for the future

position of the Brazilian Vegetable Oil In-

dustries Association (Abiove) technicians,

about 1%, “due to rising pressure against

advances into native areas”.

Nevertheless, as observed by the tech-

nical department of the official organ, the

trend is for bigger expansions of the crop

in pasturelands, besides occupying avail-

able lands and replacing other crops. The

new areas include the cerrado regions

identified as Matopiba (acronym with the

first letters of the states of Maranhão, To-

cantins, Piauí and Bahia), in the North-

east and North, in addition to anticipating

some migration movements to the north-

ern states of Pará and Rondônia.

Abiove officials insist on the need to

boost productivity, now at about 3 thou-

sand kilograms per hectare. Within this con-

text, projections by Mapa officials for the

next 10 years point to an increase of 35.1%

and30.2%inarea, not asmuchas in thepre-

vious decade (66%). The perspective is for a

crop of upwards of 100 million tons in the

2016/17 growing season, and 129 million

tons in the 2025/26 season. Under such cir-

cumstances, exports are supposed to soar

more (41%) than domestic consumption

(22.6%). The production of soybean meal is

supposed to go up 24.5%and oil, 23.4%.

For the next crop, although corn is now

more profitable than soybean, the latter

“will continue as the most important crop,

for its domestic and external liquidity”, says

Argemiro Luís Brum, professor of econom-

ics, analyst and agricultural consultant. He

also stresses the fact that Brazil, now the big

global supplier of the kernel (42.2% of total

global exports), thoughwith a smaller share

in the export of soyderivatives (22.8%of soy

meal and11.4%of oil). Furthermore, he em-

phasizes “the Country is on its way to con-

quering the position as biggest individual

producer of soybean over the next years”.

14