High jump (and long

jump

)

The most exported fruits from Brazil

showed positive results in 2017, contribut-

ing towards the sales of US$ 812.846 mil-

lion in revenue and 861.501 thousand tons,

outstripping the results of the previous year.

Mangoes and melons ranked first and sec-

ond, as usual, with respective values of US$

205.111 million and 162.916 million, ac-

cording to data from the Agrostat System

of the Ministry of Agriculture, Livestock and

Food Supply (Mapa). The next positions,

in dollar terms, were occupied by grapes

(up 47.43%), lemons and limes (-8.72%),

canned fruits and preparations, without

juices (37.09%) andapples (128.49%). Grape

and apple exports dropped considerably in

l

MAJOR CLIENTS

The countries of theEuropeanUnionare themaindestination for theBrazilian fruits.

The bloc imported around 67% of the total fruit shipments in 2017. The biggest buyers

were the Netherlands (Holland), with US$ 313.565 million, and the United Kingdom,

withUS$ 135.599million, according to data releasedby theMapa. The thirdbiggest rev-

enue, US$ 127.176million, came from the United States. In 2017, according to Eduardo

Brandão,advisortotheNationalFruitFarmingCommitteeattheBrazilianConfederation

of Agriculture and Livestock (CNA), all changes occurred within the normal rules in the

worldof businesses,without relevant ruptures in thedistributionstructure.

Brandão observes that e-commerce is on a rising trend in Asia and in the USA. In

the long run, this trade option could mean a new design in the distribution environ-

ment. Likewise, thepressureoncost reductions suggests that scaledproductioncould

mean the survival of the distributors. “Huge retail networks seek to eliminatemiddle-

men in the process, and the distribution challenges in this model have been the sub-

ject of studies and analyses by the fruit supply chain”, he says.

Demand for

tropical fruit is

on the rise in all

markets around

the world

2016, due to a production shortfall caused

by adverseweather conditions.

In all, Brazil shipped abroad 26 types of

fruits, 23of them, freshanddry.Whilst some

fruitregistered increases in volume and val-

ue, others showed declines. “These oscilla-

tions are no surprise in this sector and, in

general, they stem from the behavior of

the market, like offer and demand, com-

petitors, among others, and also technical

questions linked to production”, explains

Eduardo Brandão, advisor to the National

Fruit Farming Committee at the Brazilian

Confederation of Agriculture and Livestock

(CNA). The climate, for example, could af-

fect the supply volume, fruit quality and

Themajority of the 26 items on the

Brazilian fruit export list registered

higher values and volumes in 2017

equally the declining or rising consump-

tion of certain species. Commercial bar-

riers could also interfere with the perfor-

mance of certain fruits in specific periods.

Some fruits exported by the Country

are now on a rising trend as far as interna-

tional demand goes. For example, Brandão

cites avocado and açaí derivatives. None-

theless, he clarifies that there is mounting

concern in the sector because of the chanc-

es for this trend to lead to a non-planned

increase in the production areas and, as a

result, to excessive volumes in the future.

“This would be a disaster for this supply

chain, seeing that themarket makes an ac-

curate reading of the question of offer and

demand, and prices would certainly plum-

met, creating a problem for the activity’s fi-

nancial sustainability”, he says.

In Brandão’s view, although demand

for avocado is rising expressively in the

United States and in China, it is pertinent

to consider that up to the present, Brazil

has had no access to these markets, and

the benefits from this trend will not mate-

rialize in the short run. “This is entrepre-

neurial maturity which, associated with

the well-definedmarketing strategies, like

the positioning of products, for example,

could appropriately take advantage of

these opportunities”, he evaluates. Avo-

cado shipments went up 59.98% in value

and 58.26% in volume in 2017.

32

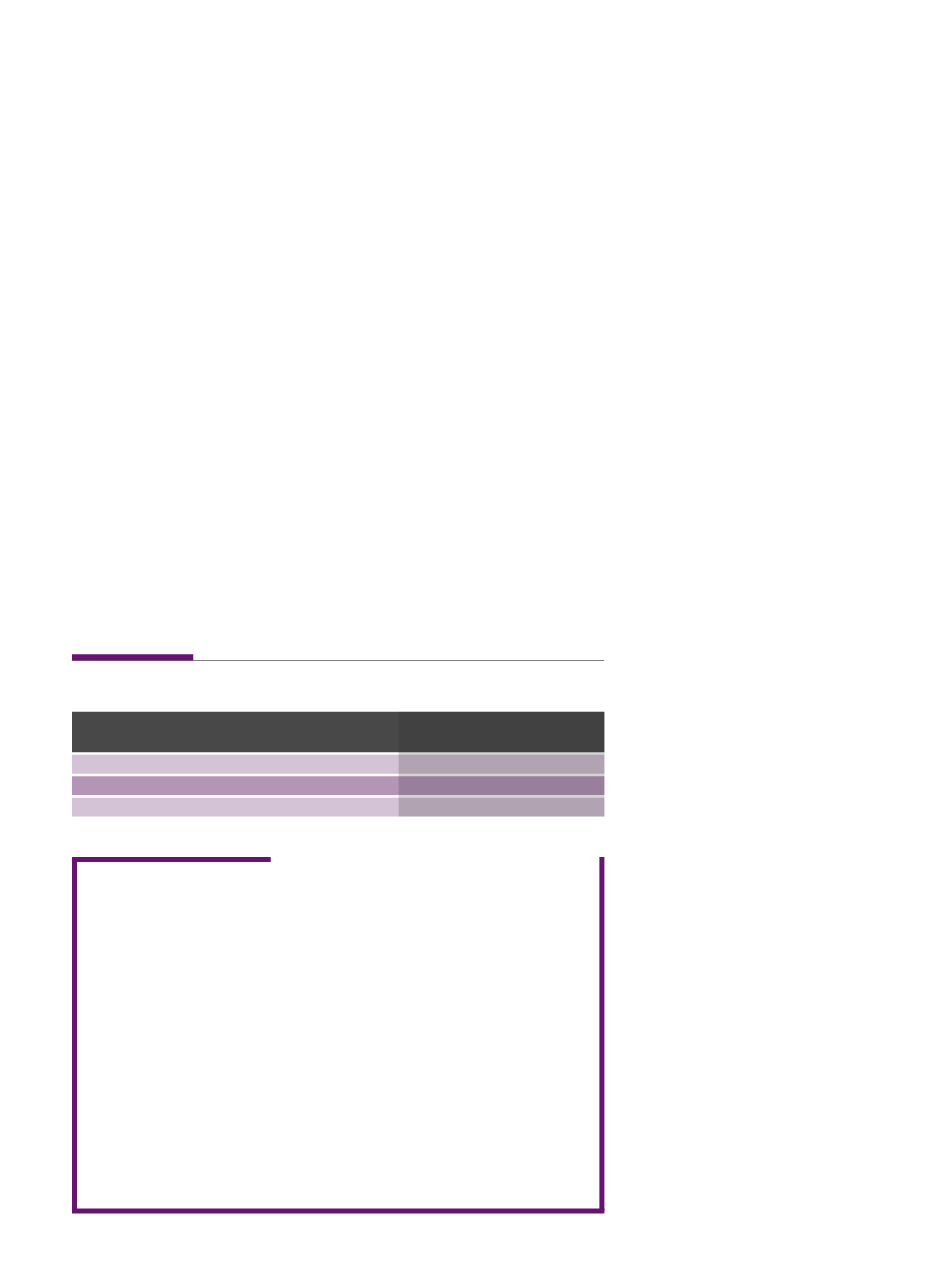

IDAS E VINDAS

•

INCOMING AND OUTGOING

Valores e volumesde exportaçãoe importaçãode frutas porpartedoBrasil

Exportação

Importação

Valor (US$ Fob) Volume (kg) Valor (US$ Fob) Volume (kg)

2015

746.487.694 729.185.637

718.036.387 519.584.805

2016

734.616.603 712.247.183

736.208.688 566.037.197

2017

946.792.837 878.400.805

723.908.490 494.906.396

Fonte: Agrostat/Mapa.