n

n

n

The most developed

Amidall technologies nowused in the cultivationof the cereal, corn seed is theone that developed themost in thepast years, say

Israel Alexandre Pereira Filho and Emerson Borghi, researchers at Embrapa Corn and Sorghum, upon announcing the existing culti-

var alternatives for the 2016/17 crop year. Their survey ascertained the availability of 315 options for the farmers, while in the previ-

ous season this number amounted to 477 cultivars.

The reduction results from the failure in providing information or from themerger of some companies that reduced their portfo-

lio as a commercial strategy, a fact that suggests that the real number could be close to the previous number, the researchers con-

clude. Still according to the survey, 214 cultivars incorporate transgenic technology, focused particularly on the control of pests and

resistance to glyphosatemolecules. The researchers also ascertained the predominance of earlymaturing seeds.

Corn

seedcommercializationforthe

2016/17growingseasoninBrazilwentup

nearly10percent,tighteningtherelation

betweenvolumessoldandsupplied

S

ales of corn seed are on the rise

throughout the Country, and

the 2016/17 season registered

the biggest volume ever com-

mercialized. The total reached

18.7 million sacks, up 9.87 percent from

the previous period, according to the num-

bers ascertained by the São Paulo State As-

sociation of Seed and Seedling Producers

(APPS). The volume available in the market

amounted to 21.4 million sacks, translat-

ing into a supply and sales relation of 87.48

percent, the highest in nine years (in the

2007/08 season it was 88.51 percent).

“The corn seed market experienced

an unexpected growth in the past sum-

mer crop, resulting into tight supply”, ob-

serves Cássio Camargo, executive director

at APPS. To this end, he recalls that con-

tributions also came from technology al-

terations in the sector, as is the case of the

replacement of single cultivars with oth-

ers that contain more than one transgenic

event (stacked) and the insertion of more

efficient options.

As far as profit go, the 2016/17 season

market, including the summer and winter

productive periods, amounted to values of

R$7.2billion, while in theprevious season it

was R$ 5 billion, according to data from the

association. The resultwas seenas good for

the segment, which is now going through a

period of company mergers (as is the case

of the Dow and Dupont merger), which, in

turn, requires necessary adjustments.

Forthenextseason,whenasmallercrop

is likely, the entity of the segment antici-

pates levels of demand in line with reduced

volumes, resulting into a good balance re-

garding the supply side. Chief executive

Cássio Camargo recalls that the sector al-

ways operates several years in advance

when it comes to market need projections,

domestic market for the most part, facing

hardly any difficultymeeting the needs.

Corn seed exports are still very small

and insignificant. Only some countries im-

port our corn seed, like Paraguay and the

United States (in the South region), where

Brazil has to compete with other suppli-

ers. In 2016, exports of corn seed soared

slightly, totaling 30.9 thousand tons, but

in 2017 there was a decline. The presi-

dent of the Producers’ Association under-

stands that there are difficulties in mak-

ing progress in these operations, and the

main reason lies in the excessive amount

of official bureaucracy.

n

45

para o exterior

abroad

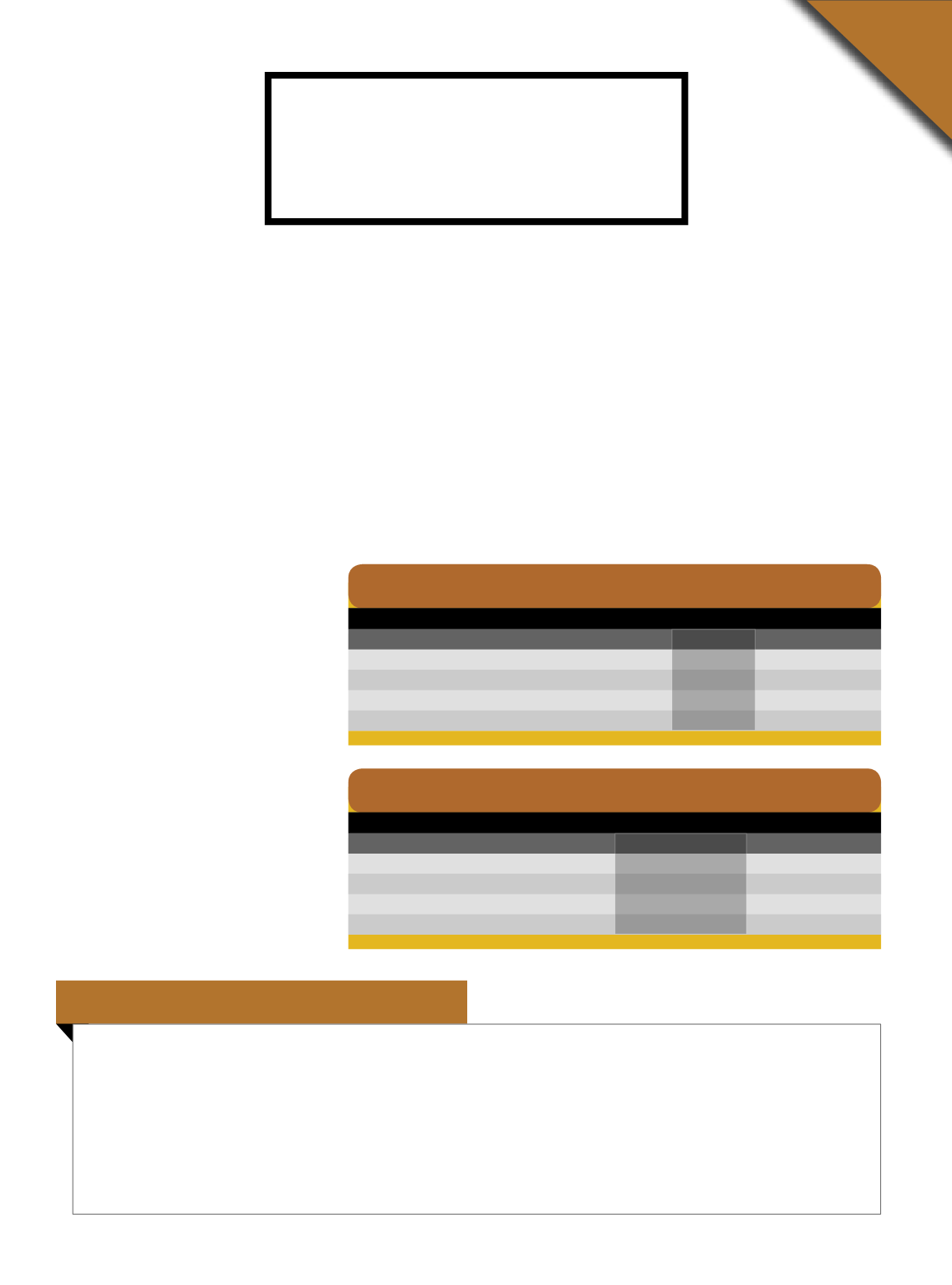

Exportação de sementes de milho no Brasil

Fonte:

MDIC/Aliceweb.

Ano

US$

Kg

2015

71.370.873,00

21.150.183,00

2016

84.761.116,00

30.964.642,00

2016 jan/jun

32.092.801,00

14.418.806,00

2017 jan/jun

17.434.276,00

5.674.542,00

NO ARMAZÉM E NO MERCADO

in the warehouse and in the market

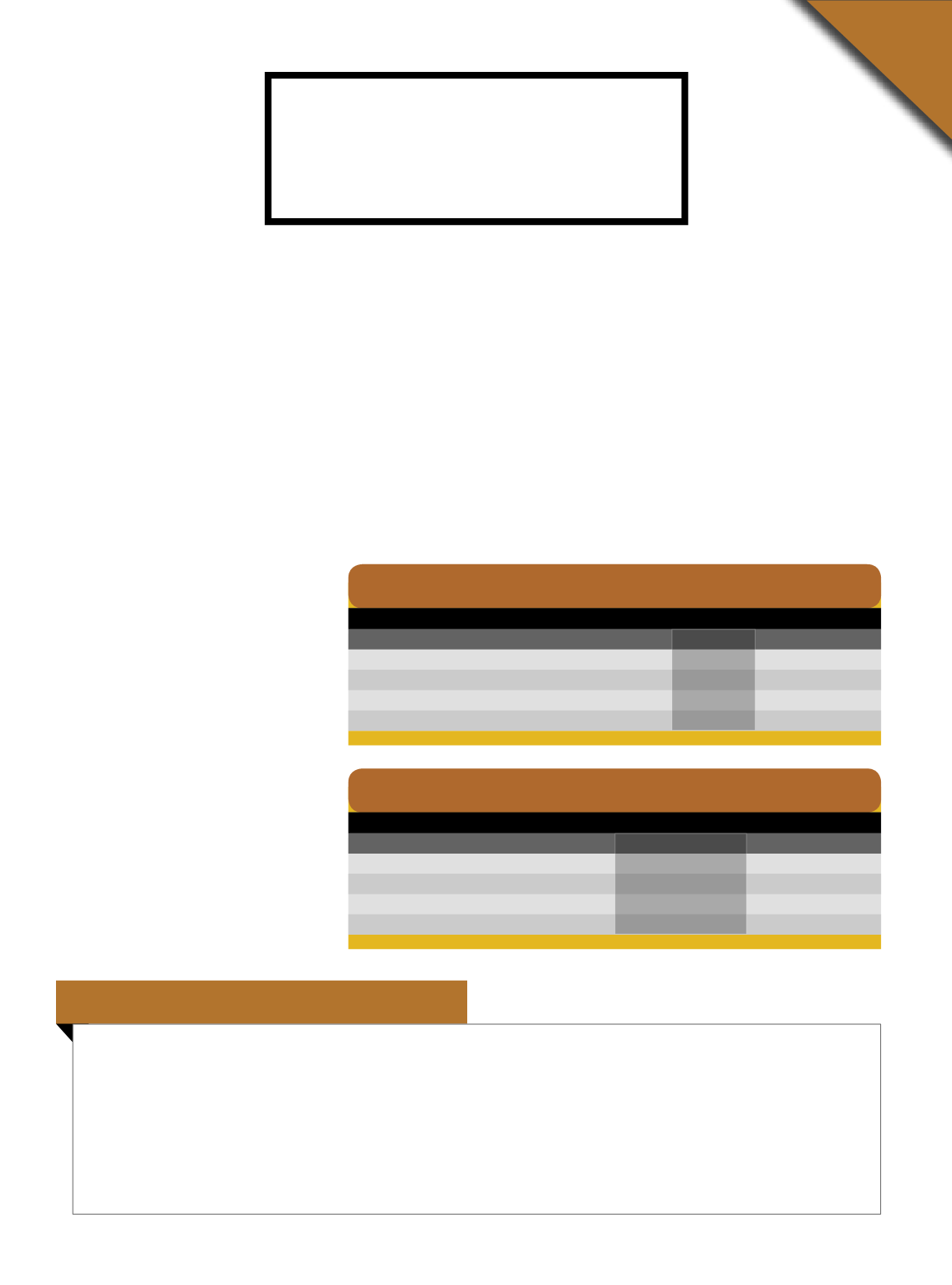

Oferta e demanda de sementes de milho no Brasil (em mil sacas)

Fonte:

APPS * Disponibilidade em 23/06/2017.

Safra

Oferta

Venda %Venda/Oferta

2014/15

21.007,00

16.711,00

76,98

2015/16

20.221,00

17.053,00

84,34

2016/17

21.419,00

18.737,00

87,48

2017/18*

23.706,00

---

---