At a high level

2015/16 sugarcane growing season reaches its highest volume, with

climate conditions favorable to plant development and productivity results

The bulk of the crop was destined

for the production of ethanol

Weather conditions were favorable

for sugarcane to develop properly in the

main producing area (South Central re-

gion) in the 2015/16 growing season, but

some states experienced difficult harvest-

ing conditions. The fact is, the area har-

vested during the season of the crop in

Brazil registered a reduction (3.9%), but

the volume harvested increased greatly

(4.9%) and reached the highest amount,

according to data detected by the Nation-

al Food Supply Agency (Conab) at the

past decade. The total volume amounted

to upwards of 665 million tons.

Excessive precipitation was registered

in the months of November and December

2015, especially in the states of Mato Gros-

so do Sul and Paraná, as well as in the lead-

ing sugarcane producing state, São Paulo.

This made harvest operations difficult, and

part of the crop was left in the field for next

year, thus reducing the number of hectares

harvested in this growing season, say Conab

sources. Furthermore, the state agency men-

tioned the influence exerted within this as-

pect by the cessation of operations of two

production units in the State of Alagoas.

On the other hand, productivity made

a good recovery in this growing season,

with favorable climate conditions through-

out the South Central region and, by coin-

cidence, by higher rates where this factor

interfered with the harvest: 26.9% in the ter-

ritory of Mato Grosso do Sul and 17.9% in

the state of Paraná, says Djalma Fernandes

de Aquino, from Conab. In São Paulo, per-

formance per area equally went up con-

siderably: 12.1%. The Northeast, in turn,

had to put up with drought conditions, re-

sulting into a smaller production volume,

but this did not prevent the Country from

achieving a positive final figure.

Productivity in the 2015/16 growing sea-

son achieved the best results in the past five

years, with 76,909 kilograms per hectare,

while the production volume is the highest

since the 2005/06 growing season, accord-

ing to Conab numbers. In area, over a pe-

riod of 11 years, the 2013/14 and 2014/15

growing seasons were more expressive

than the present one and, in volume per

area, the highest level was achieved in the

2009/10 growing season (with 81,585 kg/

ha). In the South Central region, the per-

formance of the past crop again exceeded

80 tons per hectare: 80.2 t/ha, according to

Conab sources; and 83 t/ha, according to the

Sugarcane Technology Center (CTC).

Anyway, the so-called Total Recoverable

Sugar (ATR, in the Portuguese acronym) did

not keep pace with the improvement in pro-

duction, dropping in the general estimate

of the Country conducted by Conab, from

136.52 to 131.44 kg/ton of sugarcane, with

influence upon the production of deriva-

tives. The total volume of sugar decreased

by 5.8%, while the production of ethanol

went up 6.3%, due to the higher price of this

hydrated fuel (13.7%). Therefore, taking the

sugarcane crop as a whole, the destination

for the production of biofuel was not only

prevalent, but it equally went up.

This happened, as emphasized by ana-

lyst Djalma Aquino, because the consump-

tion of ethanol in 2015 rose considerably,

mainly due to the more favorable econom-

ic relation compared with common gasoline

prices. This stimulus occurred, in general, as

a result of the higher price of the fossil fuel

and because of tax alterations in producing

states, which favored hydrated ethanol.

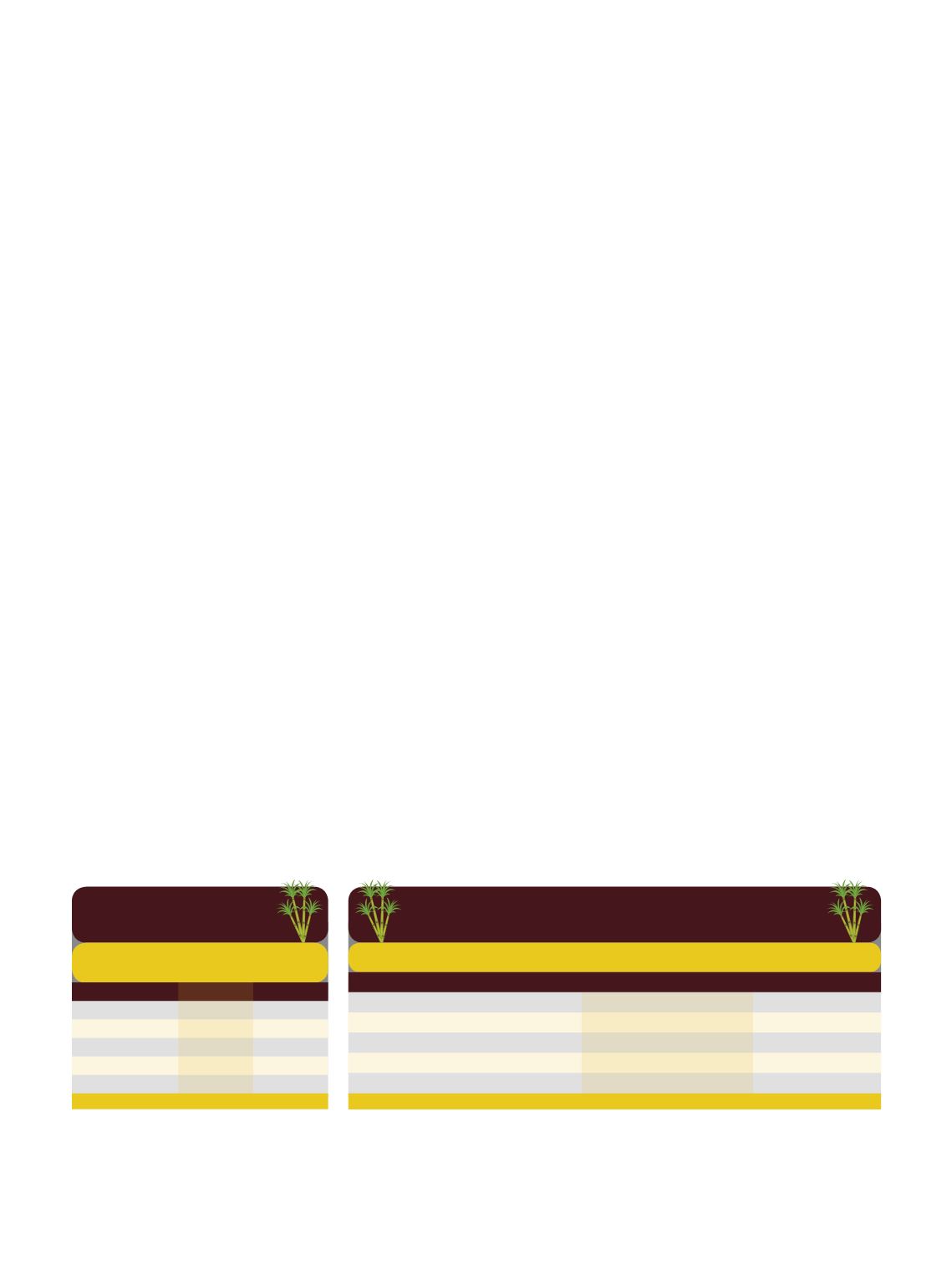

14

OPÇÃO LÍQUIDA

Liquid option

Mix de produtos da cana brasileira

favorece etanol (%)

Safras

Açúcar Etanol

2011/12

49,8

50,2

2012/13

49,7

50,3

2013/14

45,2

54,8

2014/15

43,1

56,9

2015/16

40,4

59,6

Fonte:

Conab

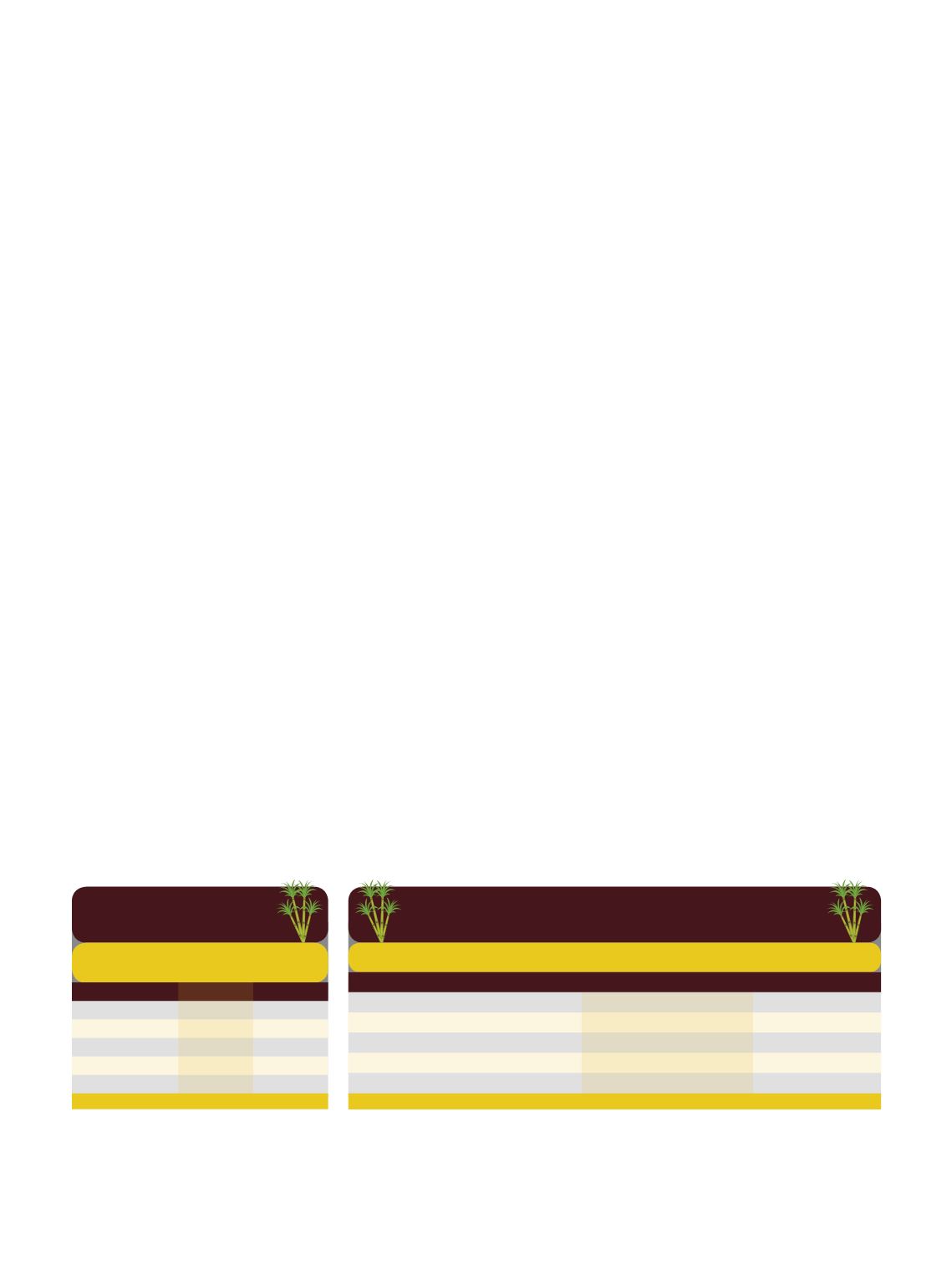

CANA E SAFRAS

Sugarcane and crops

Últimos números da cana-de-açúcar no Brasil

Fonte:

Conab

Safra

Área (mil ha) Produtividade (kg/ha) Produção (mil t)

2011/12

8.362,6

67.081

560.955,2

2012/13

8.485,0

69.407

588.915,7

2013/14

8.811,4

74.769

658.822,3

2014/15

9.004,5

70.495

634.767,0

2015/16

8.654,2

76.909

665.586,2